Table of Contents

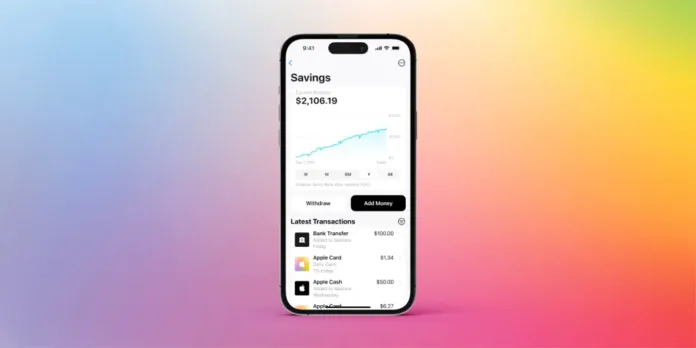

The Apple Card shake-up is entering a critical phase as Goldman Sachs prepares to exit and JPMorgan Chase moves closer to a 2026 takeover. The shift could reshape fees, rewards, and credit access for millions of users. Launched in 2019, Apple Card has been backed by Goldman Sachs since day one, but mounting losses are now pushing the bank toward the exit despite the card’s popular cash-back and fee-free appeal.

Why Goldman Sachs Is Exiting the Apple Card Shake-Up

Goldman Sachs records heavy losses from Apple Card. The partnership drains over $1 billion in direct costs. Consumer products lose $6 billion overall. Credit defaults drive much of the damage.

Apple Card skips standard fees. Users pay no annual charge. Late payments carry no penalty. Foreign transactions cost nothing. Returned payments avoid fines. Banks rely on these fees for profit. Goldman Sachs forfeits that income.

Rewards reach 3% cash back at select partners. Apple purchases qualify for 0% APR plans. These benefits pull in customers. Subprime users qualify easily. Subprime describes scores under 660. Apple Card hits 34% subprime share.

Delinquency rates climb to 4%. Industry norms sit at 3.05%. High-risk borrowers stress the books. Goldman Sachs CEO confirms exit plans. Contracts run through 2030. Early closure looks likely. The bank retreats from retail finance. Savings products like Marcus stay open to all.

Apple Card grows to $20 billion in balances. User base expands steadily. Device buyers fuel spending. Goldman Sachs hunts for buyers now. American Express considered bids. CEO Stephen Squeri weighed options in 2023. Deals must boost distribution. Brands share premium gains. Subprime volume scared off Amex.

Capital One handles subprime at 31%. Synchrony joined early talks. None holds strong positions today. The Apple Card shake-up stems from fee-free appeal. Apple prioritizes user perks. Banks chase margins elsewhere.

Goldman Sachs jumped into consumer banking with Apple. Losses teach hard lessons. Retail proves tougher than expected. Millions carry Apple Cards. Daily cash back deposits build loyalty. Family accounts divide expenses. Privacy features block merchant tracking.

Sale talks heat up. Apple vets new issuers. Mastercard stays as network through 2026. Transitions demand planning.

Why JPMorgan Chase Is Leading the Apple Card Shake-Up Deal

JPMorgan Chase leads the race. Reports place Chase in final talks. Apple favors Chase as Goldman replacement. No contract signs yet. Chase dominates U.S. card issuance. Purchase volumes top charts. Apple Card adds massive scale. $20 billion shifts over smoothly. Subprime risks linger. Chase limits subprime to 15%. Apple Card doubles that rate. Defaults inflate expenses.

Buyers seek steep discounts. Portfolios trade below book value. Chase negotiates service fees. Apple grants key terms. Discussions began in 2024. Amex and others drop out. Barclays quits early. Chase pushes forward alone.

Mid-2025 reports show progress. 2026 timing matches expiration windows. Goldman Sachs accelerates the split. Apple Card shake-up may trim perks. Late fees could return. Cash back rates face cuts. Generosity shrinks to fit new math.

Chase runs successful co-brands. Apple link elevates status. Tech powers everyday finance. Chase scales operations. Apple secures long-term stability. Users see minimal disruption. Data ports over cleanly. Credit lines carry forward. Scores refresh without gaps. App backend swaps quietly.

U.S. focus sets stage for global growth. Apple eyes international cards next.

Capital One waits in wings. Discover merger builds networks. Earnings power absorbs hits. Subprime know-how fits well. Chase CEO Jamie Dimon targets expansion. Cards cement market lead. Users anticipate changes. Prime borrowers keep easy access. Subprime faces stricter checks.

Savings Account Splits from Apple Card Shake-Up

Apple Card Savings ties lightly to the card. Goldman Sachs runs it today. Cardholders gain entry only. Cash back flows in automatically. Links stay surface-level. High yields draw deposits. Rates top traditional banks. Compounding works daily. Chase skips savings offerings. Apple Card version fills a gap. Goldman keeps Marcus alive publicly. Separate paths make sense.

Goldman Sachs trims consumer lines. Savings proves profitable enough.Apple Card shake-up leaves savings intact likely. Users select deposit paths. FDIC covers all funds.

Yields hover above 4%. Promos spark early growth. Fed policy shapes rates ahead. Post-deal, Apple sharpens focus. Issuers handle backends. Apple owns the front end.

Changes pinch subprime users most. Access tightens gradually. Rewards favor strong credit. Satisfaction rankings dip. J.D. Power drops Apple to third. Service limits hurt scores.

2026 delivers answers. Deals close by mid-year. Apple times news with product cycles. Users prep for transitions. Data exports run simple. New systems launch fast. Apple Card shake-up redefines partnerships. Fintech demands flexibility.

Squaredtech will track confirmations, issuer changes, and user-level impacts as the Apple Card deal develops.

Stay Updated: TechNews