Table of Contents

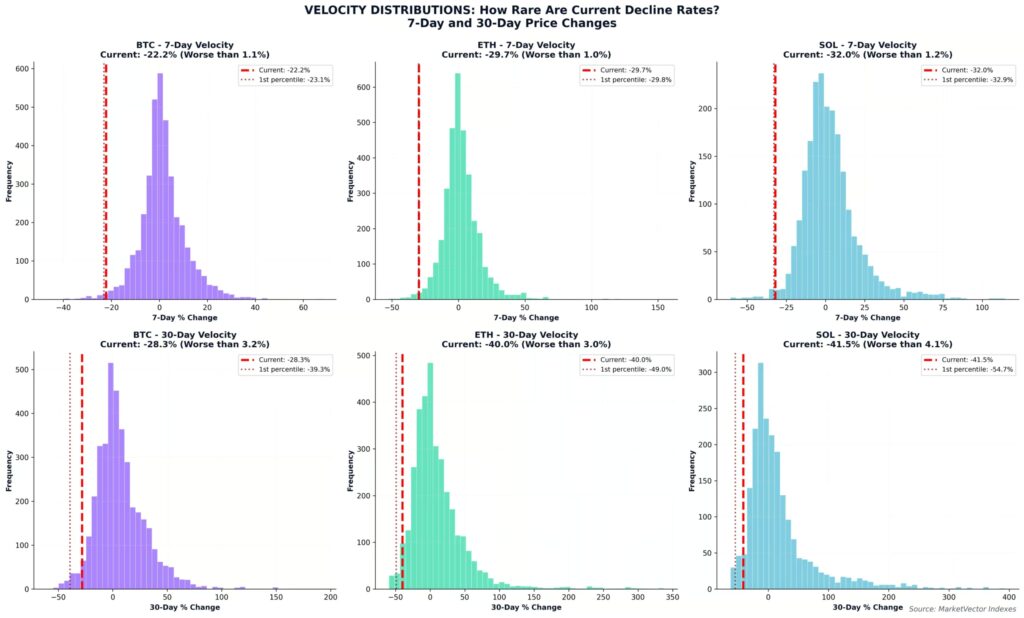

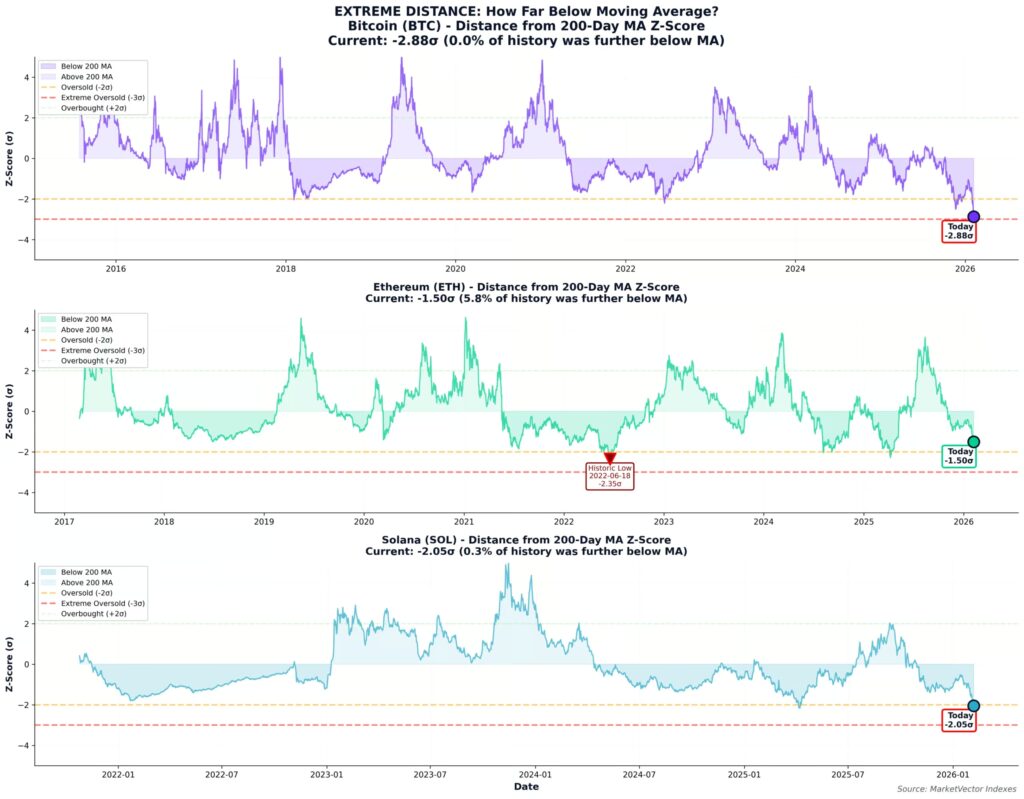

At SquaredTech.co, we view Bitcoin’s fall below its 200 day moving average as one of the most extreme pricing events in its trading history. Bitcoin dropped more than 22 percent in a single week and briefly fell below 60000 dollars before rebounding near 70592 dollars. MarketVector Indexes data shows Bitcoin trading 2.88 standard deviations below its long term trend. This level exceeds stress recorded during the COVID market shock and the FTX collapse. In statistical terms, Bitcoin has entered territory that has not appeared in over ten years of price data. The speed and depth of this decline reflect panic driven selling and forced leverage unwinding rather than a structural failure in the asset itself.

Why the 200 Day Average Breakdown Matters

The 200 day moving average serves as a key reference point for long term market direction. When price trades far below this level, it signals extreme dislocation between market sentiment and historical trend. Analysts often watch such moments for signs of mean reversion, a process where price moves closer to its long term average after sharp deviation. Mean reversion does not confirm a lasting bottom, but it raises the likelihood of a short term rebound. Several indicators now sit at rare extremes, including volatility and drawdown depth. Markets rarely remain in these conditions for extended periods, which is why analysts describe the current zone as reactive rather than stable.

What Is Driving the Sell Off

Analysts emphasize that the current downturn reflects macro economic pressure rather than any failure in Bitcoin’s network or function. Rising interest rates, tighter liquidity, and broader risk reduction across equities and digital assets continue to weigh on price action. Bitcoin’s core systems continue to operate without interruption despite the decline. This distinction matters for long term investors evaluating risk. A macro driven downturn often resolves differently from one caused by internal breakdown. The present decline aligns with global market stress rather than asset specific weakness.

Market Sentiment and the Near Term Outlook

Market sentiment confirms the severity of the current phase. The Crypto Fear and Greed Index dropped to 9 out of 100, signaling extreme fear across the market. At the same time, on chain and exchange data show large investors and hedge funds accumulating positions during the decline, particularly on major platforms such as Binance. Traders describe the move as a leverage reset that cleared excessive risk from the system. Over the coming weeks, price behavior near this zone will help determine whether Bitcoin forms a temporary base or extends a deeper correction driven by global conditions. Extreme statistical signals do not remove uncertainty, but they do suggest the market has entered a rare and decisive phase.

Stay Updated: Crypto