The Article Tells the Story of:

- A Record-Breaking Crypto Surge: Crypto funds hit an all-time high of $167 billion in assets during May 2025, as investors rush to hedge against market swings.

- Bitcoin Outshines Stocks and Gold: Bitcoin surged over 15% in three months, beating the MSCI World Index and gold, signaling a major shift in investor confidence.

- Massive Cash Exodus from U.S. Markets: While crypto funds gained $7.05 billion in May, equity funds lost $5.9 billion and gold saw its first outflow in 15 months.

- Wall Street’s New Favorite Hedge: Institutional inflows into bitcoin and ether ETFs hint that crypto is no longer fringe—it’s becoming a permanent part of global portfolios.

Crypto Funds Set a New Record in May

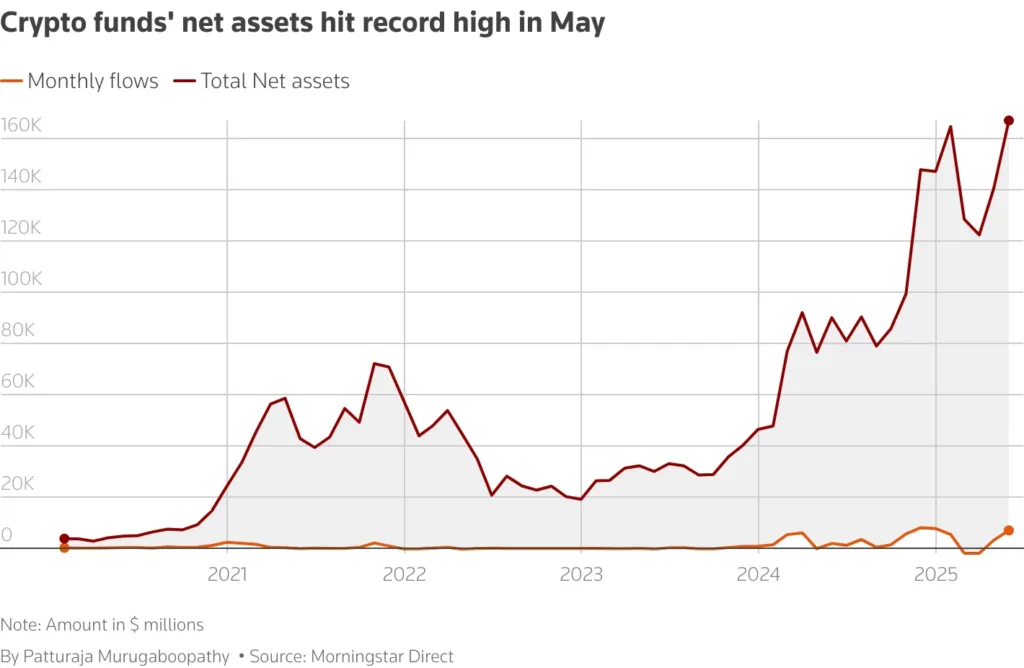

Crypto funds reached a record $167 billion in assets under management in May 2025. Investors poured $7.05 billion into these funds last month, according to Morningstar data covering 294 crypto investment vehicles. This marked the highest monthly inflow since December.

Analysts say this surge reflects rising investor interest in alternative assets. Many investors are using cryptocurrencies like bitcoin to hedge against rising volatility and to reduce their exposure to U.S.-centric portfolios. Trade tensions have eased, and risk appetite has improved, further fueling demand for digital assets.

Nicolas Lin, CEO of Aether Holdings, said more investors now view bitcoin as a serious hedge rather than just a speculative asset. “Bitcoin is starting to come into its own again,” Lin said. “It’s now a part of more portfolio strategies.”

Bitcoin Gains as U.S. Market Confidence Wanes

Bitcoin prices have jumped more than 15% in the past three months. This performance outpaced the 3.6% gain of the MSCI World Index and even beat the 13.3% increase in gold. Analysts attribute this outperformance to declining faith in traditional U.S. investments.

Nic Puckri, founder of Coin Bureau, explained the trend. “The greenback is projected to keep plummeting, bond yields are rising, there’s uncertainty about the equity markets. But bitcoin seems to be holding strong,” Puckri said.

Institutional investors are also fueling bitcoin’s rise. Since the approval of spot bitcoin and ether ETFs in the U.S., large inflows have pushed up prices. These ETFs made it easier for traditional investors to gain exposure to crypto without directly buying coins.

CoinShares data shows that bitcoin funds attracted $5.5 billion in net inflows during May. Ether funds brought in another $890 million. These numbers show that both institutional and retail investors are shifting money into digital assets.

Investors Turn to Crypto as U.S. Equities and Gold Fall

Crypto’s rising popularity comes as other asset classes show signs of weakness. Global equity funds saw net outflows of $5.9 billion in May, according to Lipper data. Gold funds also lost $678 million, marking their first outflow in 15 months.

These shifts suggest that investors are no longer confident in traditional assets. Many are now turning to crypto funds as an alternative. The data supports this. While stocks and gold lost money, crypto funds gained record inflows.

Lin believes this is the beginning of a long-term change. “That initial wave was a bit of a release valve,” Lin said. “What’s happening now is more important. It’s the start of crypto becoming a permanent fixture in diversified portfolios.”

Crypto funds have moved from a niche option to a mainstream asset class. As U.S. markets face pressure and gold loses appeal, bitcoin and ether are becoming core components of investment strategies.

Crypto Funds Grow as Investors Seek Safe Havens

Bitcoin’s performance and investor sentiment show that digital assets are gaining traction as safe havens. As concerns rise about the dollar, inflation, and global equities, crypto offers a new option.

The $7.05 billion net inflow in May reflects this new trend. It is not just about chasing returns. Investors are now using crypto as a serious tool to manage risk. With bitcoin’s growth outpacing stocks and gold, this trend may continue into the second half of 2025.

Crypto funds now stand at the center of a changing investment landscape. They offer a way to hedge, diversify, and possibly outperform. The numbers from May confirm that more investors see value in this strategy.

Stay updated: Crypto News